Feds move to ease FAFSA financial aid chaos, but no quick fix emerges

Under enormous pressure, federal education officials announced Tuesday another round of steps to ease a crisis caused by the trouble-plagued rollout of the key form used by aspiring college students to calculate all-important financial aid packages linked to their upcoming college acceptances.

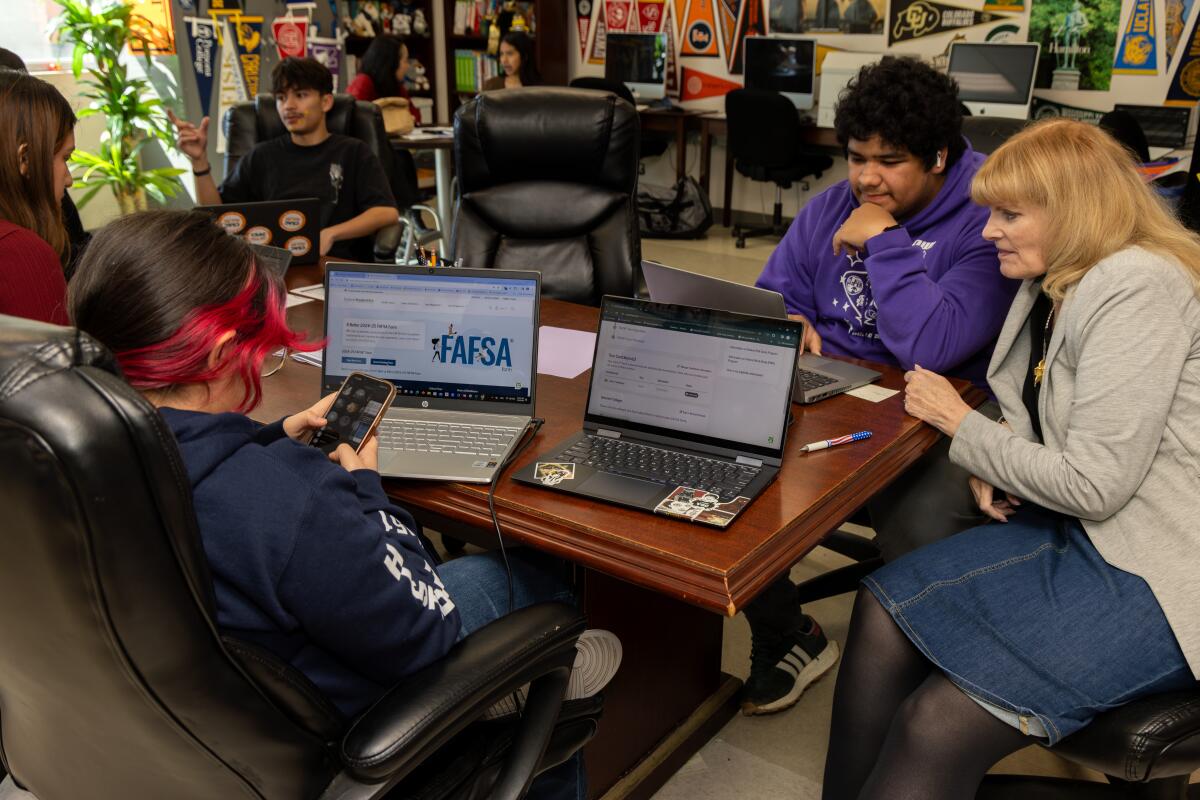

The online form, known as FAFSA, or the Free Application for Federal Student Aid, which was previously available in late October, did not become fully accessible until mid-January. That delay and numerous computer glitches have resulted in a steep drop in the number of submissions — by about half as of late January.

The frustrating irony for students is that the new system was supposed to make things easier and faster but has so far resulted in just the opposite.

The steps announced Tuesday don’t actually fix the computer problems students have encountered with the forms. Instead, the Department of Education diminished — at least temporarily — federal oversight of the financial aid system to streamline the process. Fewer students will have to verify their identity or financial information; a smaller number of colleges will face program reviews and such reviews can be delayed past the current crunch period.

Officials said they still would be able to target suspected fraud or prevent it in part because the new form connects online directly to tax information parents have filed with the Internal Revenue Service.

“Our top priority is to ensure students can access the maximum financial aid possible to help them pursue their higher education goals,” U.S. Secretary of Education Miguel Cardona said in a Monday telephone media briefing. “These steps reflect the many conversations my colleagues and I are having with college and university leaders, financial aid administrators, students and parents, and others who are on the front lines.”

Democratic lawmakers, loath to criticize the Biden administration in reelection mode, expressed exasperation in a Monday letter to Cardona’s agency.

“Any delays in financial aid processing will most impact the students that need aid most, including many students of color, students from mixed status families, students from rural backgrounds, students experiencing homelessness or in foster care, first-generation students, and students from underserved communities,” wrote the lawmakers, who included Sen. Bernie Sanders (I-Vt.) and Sen. Alex Padilla (D-Calif.).

A chaotic rollout of a new federal financial aid form is roiling high schools and upending college admissions, impeding students from filling out the all-important FAFSA form.

Especially withering criticism has come from Republicans in Congress, including Sen. Bill Cassidy from Louisiana.

“The Department of Education has had over three years to prepare and yet students are still not able to use their completed applications to secure federal, state, and campus-based financial aid,” Cassidy wrote Cardona in a Jan. 12 letter. “This is unacceptable and does not appear to be consistent with industry standards for website development and launch.”

He added: “The botched rollout means students will be forced to make financial aid decisions with less time and less information than in the past. Where to go to college, and how to finance it, is one of the most important financial decisions a person will make in their lifetime. ED needs to be making that decision easier, not harder.”

Cassidy and other Republican lawmakers have called for an investigation.

Each year, about 17 million students fill out the FAFSA as a first step to accessing financial aid. The feds turn over the processed applications to colleges, which use them to craft financial aid packages. The Education Department had predicted that the new FAFSA would result in 610,000 more students from low-income backgrounds becoming eligible to receive a federal Pell Grant and 1.5 million more becoming eligible to receive a maximum Pell award of $7,395.

The latest actions follow those announced last week, including assigning assistance teams to help colleges manage the new process and the crush of data arriving later than usual. The department also pledged $50 million for nonprofits to provide similar assistance for both colleges and families.

Education Department officials said a shortage of funding contributed mightily to the problems.

Congress had “set deadlines requiring us to undertake three massive modernization projects within a few months of each other,” said a senior department official, who spoke on condition of not being named.

The official was referring to the complex fall resumption of student loan payments as well as the new FAFSA.

“Congress did not provide the substantial amount of increased funding we requested to implement these ... bipartisan projects, and here we are well into the fiscal year and we don’t have a budget for this year as well. So it’s very, very challenging for us to deliver on the level of service we want to provide,” the official said.

The Democratic lawmakers also acknowledged in the letter that the Education Department has had to work with “less funding than it anticipated would be needed to complete the job correctly and on time.”

The two university systems will extend their May 1 deadline for students to accept admission offers, citing delays in financial aid applications known as FAFSA.

The latest FAFSA moves will be no panacea.

The department, for example, still has no fix for the system’s apparent breakdown when a student reports that a parent lacks a Social Security number.

“We are meeting daily to form a path forward on it,” a senior department official said. “I don’t have news to share at the moment. But it’s an issue that’s very, very important to us and we’re working very hard to find a path forward.”

One potential work-around is for families in this situation to file the paper version of the FAFSA, bypassing the computer glitch.

Officials also had no ready answer for the near-interminable waits for help and automated hang-ups on phone-assistance lines.

As a condition for taking part in the briefing, reporters had to agree to identify no senior officials by name. Only Secretary Cardona spoke on the record, but he did not take questions and left the briefing before the Q&A began.

But Cardona did talk about the technical challenge having resulted in “delays that come with completely overhauling a broken system that is older than me.”

“This is about delivering the promise of transformational change,” Cardona said. “It’s about overhauling a broken system that was failing too many students and one that we normalized in this country. It’s about making sure the doors of higher education open for so many more students whose lives can be changed for the better but had been deterred by the cost and complexity of the system.”

As of late January, about 700,000 seniors nationwide had filed applications, down from about 1.5 million applicants the same time last year, according to National College Attainment Network, which analyzed data from the U.S. Department of Education.

In California, only 16.1% of seniors had submitted a FAFSA through Feb. 2, a drop of more than 57% from that same date the previous year, according to the network’s data.

The delays prompted the University of California and California State University to announce last week that they would extend their May 1 deadline for first-year students to accept their admission offers for fall 2024. Both systems announced extensions until at least May 15. The state, which provides Cal Grants through the California Student Aid Commission, also extended the priority deadline to submit financial aid applications by one month, to April 2.

Adam Swarth, a Calabasas High senior, had been hoping to finish the college application process early. But instead, the FAFSA issues worsened and lengthened a stressful time. He’s still worried.

“We don’t understand exactly what the problems are,” he said. “We just know the problems exist. Maybe I won’t be able to go to the college of my choice because the college won’t have the financial package ready for me by the time I have to decide.”

More to Read

Start your day right

Sign up for Essential California for news, features and recommendations from the L.A. Times and beyond in your inbox six days a week.

You may occasionally receive promotional content from the Los Angeles Times.