You have until midnight on Friday to sign up for Covered California

The window to sign up for health insurance through California’s state marketplace, Covered California, ends Friday at midnight.

The window for new customers was originally slated to close on Jan. 31, but the state exchange said that it decided to extend the deadline to Feb. 9 given the large volume of demand and a cybersecurity incident earlier in the month that affected customer service call centers.

Since the insurance exchange was created in 2010, it has allowed Californians to sign up for subsidized or no-cost healthcare plans, either with insurers such as Kaiser Permanente, Molina Healthcare and Anthem Blue Cross, or with Medi-Cal, the state Medicaid program for low-income residents. More than 1.77 million Californians were enrolled in a Covered California plan as of Jan. 31. Last year, 469,000 of those enrollees were in Los Angeles county alone.

According to Covered California, 90% of customers receive some kind of subsidy to their premiums, and lower-income individuals and families can find coverage for less than $10 in premiums per month.

But rates for exchange customers are going up 9.6% on average from 2023 to 2024 because of “a continued rise in health care utilization following the pandemic, increases in pharmacy costs, and inflationary pressures in the health care industry,” according to Covered California.

Here’s what a single 37-year-old working full time at minimum wage in the city of L.A., with an income of $35,000, can find:

Bronze-tier plans, which have higher deductibles and co-pays for doctor visits, prescriptions and medical procedures, cost $21 in premiums per month at the low end, with a selection of plans in the $55 to $95 range. A silver-tier plan, which has no deductible and lower co-pays, would cost the same person $78 on the low end, and $105 to $140 for a wider range of plans.

A family of four, with two adults age 37, two kids and total income of $60,000, would be able to get a bronze plan for free or a Kaiser policy for just $2 a month and could purchase a silver-tier plan for $44 at the low end, with more options with monthly premiums of $100 to $170.

Individuals with incomes below $20,000 per year are eligible for free Medi-Cal coverage, and the income cap increases the larger the household seeking coverage. Pregnant people can also qualify for Medi-Cal at higher income levels, and the same goes for anyone up to age 18.

Thanks to a law that went into effect in 2024, undocumented people of any age are also eligible for Medi-Cal, and anyone can apply for coverage through Covered California, regardless of immigration status.

If you miss the Friday midnight deadline to enroll, you can still sign up for healthcare coverage if you experience a qualifying life event. These events include losing your prior coverage, getting married, moving into California, having a child, leaving jail or prison, and a number of other changes that could send you looking for a new healthcare plan. Anyone whose income is less than 150% of the federal poverty level can sign up any time.

And Covered California has added a qualifying life event that practically anyone can use: “needed more time to sign up.”

If you want your healthcare plan to kick in for the entire month of February, midnight Friday is the final deadline. But if you sign up from Feb. 10 to Feb. 29, you can still get coverage that begins on March 1 — and if you miss that, too, the exchange is also letting people sign up from March 1 to March 26 for coverage that begins in April.

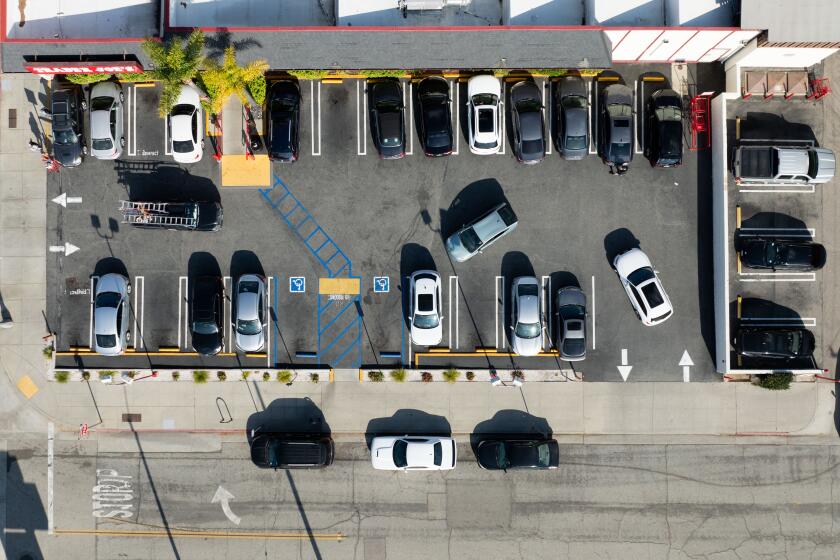

Every driver has a parking lot they dread. A civil engineer analyzed the problems at some of L.A.’s most notorious parking lots and suggested ways to fix them.